Areas of Focus: Affordable housing and community development lending, connecting customers with various types of financial, intellectual, and human capital.

Position Description

Summary

The Chief of Customer Engagement (CCE) is a collaborative member of the leadership team responsible for leading and coordinating NeighborWorks Capital’s development and engagement with customers across a variety of products and services, including but not limited to lending. As the company expands our lines of business, the CCE is responsible for ensuring we have a comprehensive strategy and actionable implementation plan for bringing our products and services to the NeighborWorks America network (the network) in a coordinated and complementary way. The Chief Loan Officer (CLO) position preceded the CCE position, but as the company has broadened its capital solution offerings to the network, we redefined the Chief Lending Officer role to better reflect our expanding set of products and services.

Leading the lending function remains a core CCE responsibility. The CCE will supervise the team members originating and closing loans and lead all efforts related to lending, including marketing, outreach, underwriting, structuring, closing, and selling participations. These responsibilities are to be carried out in a manner that meets loan production goals, satisfies lending and portfolio management policies and loan committee requirements, appropriately [aggressively] leverages our resources, and mitigates financial, legal, and reputational risks to the organization. A key collaborator in the lending function is the Chief Risk Officer. A key collaborator in the marketing function is the Chief Growth Officer.

The CCE is also responsible for the delivery of other products and services, such as energy efficiency lending and Low Income Housing Tax Credit Equity. As our products and services expand, the CCE’s responsibilities will likely increase accordingly, as this position is responsible for ensuring we have a coordinated approach for engaging our customers, even if some services may be delivered by another internal team (consulting services, for example). In addition to direct delivery of products and services, the CCE will coordinate with the Chief of Consulting to ensure our customers are informed about our consulting services and appropriate connections are made between customers, the Customer Engagement team, and the Consulting team.

Reports to: CEO

Direct Reports: Loan Officers, Underwriter, Director of Closings.

This position can be remotely located if the candidate is willing to travel to the Silver Spring office as is reasonably necessary, at a minimum quarterly for in-person senior team meetings, as well as travel to industry conferences and customer site visits.

Core Responsibilities

Leadership

- Promote a long-term view of Customer Engagement in the organization’s success and proactively lead the team to be successful.

- Define what success looks like, consistent with the organization’s vision and strategy.

- Ensure Customer Engagement team members understand what success looks like and what is required of them.

- Create an actionable plan for the Customer Engagement team and the other individuals with customer-facing roles to be successful, consistent with the organization’s vision.

- Lead the implementation of the plan with internal team members so that key findings are shared and there is effective follow-up

- Consistently and positively demonstrate support for our strategic vision, your view of success, your plan to achieve it, and your commitment to drive toward success.

- Communicate progress, celebrate successes, delegate to your team and other staff, empower your team to be leaders, and drive change.

- “Clear the path” for your team and the company on all customer engagement issues:

- Identify and understand friction points, challenges, and obstacles.

- Proactively develop solutions to reduce friction points, address challenges, and remove obstacles to the greatest extent possible.

- Develop support for those solutions from the CEO, peers (to the extent there is overlap in responsibilities or dependencies), and the Customer Engagement team.

- Implement solutions.

- Model the behavior we want to see. Align personal actions with the organization’s Operating Principles.

Lending

- Primary responsibility for loan originations, commitments, and closings

- Conduct due diligence of loan requests, recommend action on loan requests and risk ratings under established credit policy guidelines

- On an as-needed basis, provide technical assistance to borrowers in structuring their financing

- Coordinate activities of the NC Loan Committee

- Collaborate with the other senior team members in designing and upgrading loan underwriting; servicing and portfolio management policies; loan products; lending capital needs and priorities; marketing strategies; and participation partnerships and administrative systems

- Negotiate and manage consultant contracts and budgets related to lending

- Actively cultivate new and existing borrower relationships through on-site visits, video conferencing, and phone calls, and other means of communication, including emails and newsletters

- Conduct proactive outreach to market NC products to appropriate NW affiliates

- Participate in NeighborWorks® America meetings, including Training Institutes, Symposia, and Regional meetings

- Pursue new and maintain existing relationships with other CDFIs and lending partners

- Pursue and effectuate opportunities to collaborate with other CDFIs and lending partners to sell/buy loan participations

- Assess market needs and conduct research toward designing new or improved loan or technical assistance products and services

- Design and implement new products to respond to market changes, customer needs, and increased organizational capacity.

- Design and implement systems to gain customer feedback, conduct market and product research and analysis, and other projects as assigned

Minimum Experience/Qualifications

- A minimum of 15 years of experience in lending for affordable housing and community development, with progressively responsible positions.

- Demonstrated experience engaging with customers and delivering solutions.

- Demonstrated ability leading teams and businesses.

- Demonstrated experience developing and implementing strategy across teams.

- Exceptional communication and collaboration skills.

- Excellent transaction structuring, evaluation and underwriting skills.

Compensation Range

$190,000 – 215,000 depending on experience plus excellent employer-paid benefits package that includes medical, dental, vision, 11 paid holidays, PTO & sick leave, life insurance, disability, 6% contribution of eligible salary to 401(k), transportation subsidy, matching contribution plan to eligible nonprofits, and bonus potential.

About NeighborWorks Capital

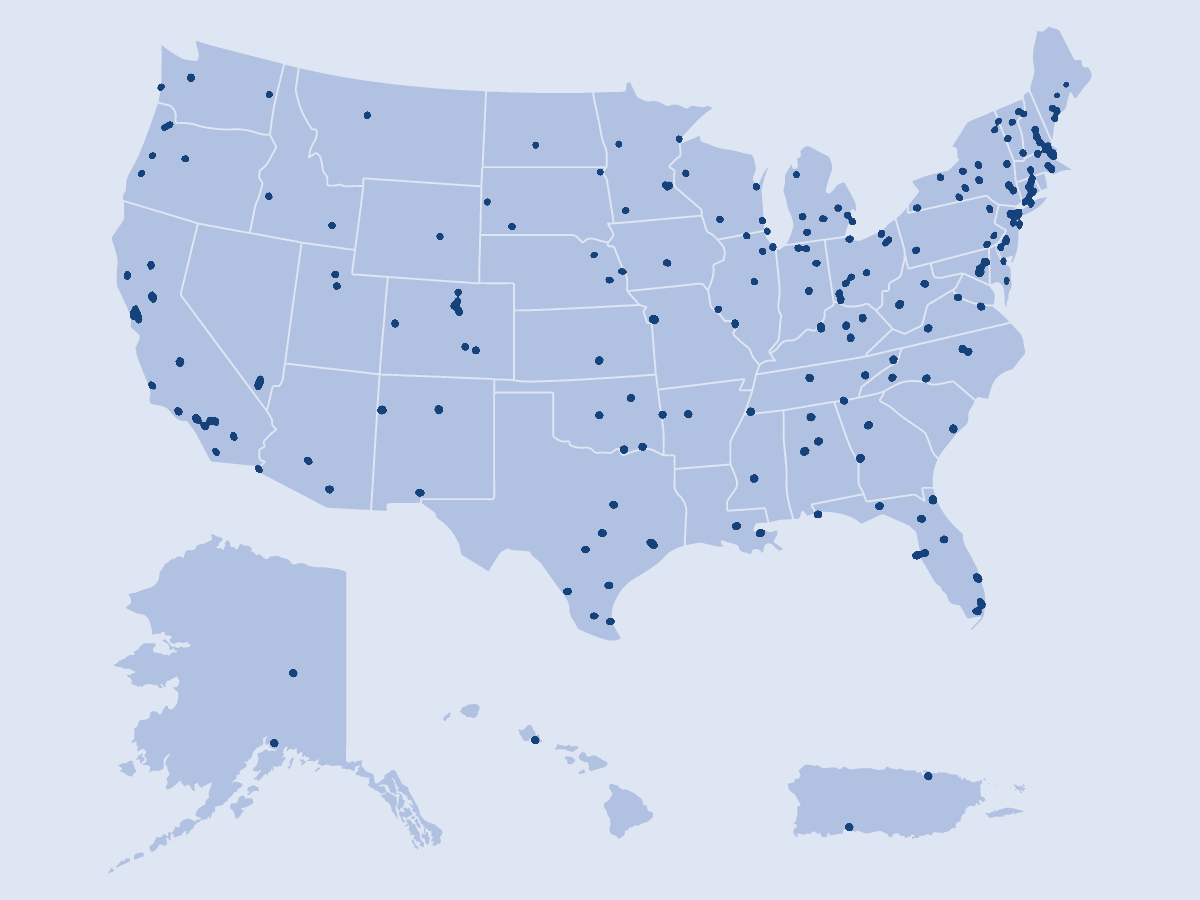

NeighborWorks Capital is a national non-profit, certified Community Development Financial Institution (CDFI) serving NeighborWorks America network organizations, nearly 250 strong, capable non-profit housing and community development organizations in every state, District of Columbia, and Puerto Rico. These organizations provide communities with affordable housing, financial counseling, training, and resident engagement in the areas of housing, health, employment, and education.

NeighborWorks Capital’s current capitalization is nearly $200 million with more than $100 million in loans outstanding nationwide. Since its inception, NeighborWorks Capital has deployed over $500 million in loan capital to support the NeighborWorks network. In 2023, NeighborWorks Capital received its first-ever S&P Global issuer credit rating of A+/Positive, sighting key strengths in capital adequacy, profitability, liquidity, and financial management. The organization has been Aeris-rated since 2011 and has an AA financial strength and performance rating, indicating strong financial capability, performance, and risk management practices.

NeighborWorks Capital is an Equal Opportunity Employer. It is NeighborWorks Capital’s commitment to treat all its employees and candidates for employment with dignity and respect and to provide a workplace that is free from discrimination, whether that discrimination is based on race, color, religion, sex, national origin, disability, political affiliation, marital status, membership in an employee organization, age, sexual orientation, gender identity, pregnancy, or other non-merit factors.

How to Apply

Please forward your resume and cover letter to jobs@neighborworkscapital.org.