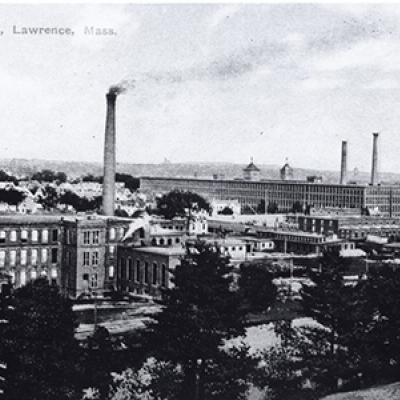

The prospect of rehabbing a former Polartec mill complex in Lawrence, MA, was a big challenge for long-time customer Lawrence CommunityWorks (LCW). At 476,000 square feet, the Marriner building is their largest redevelopment project yet. The Marriner will be redeveloped in multiple phases over 5-7 years utilizing Low Income Housing Tax Credit, New Market Tax Credit and Historic Tax Credit financing.

LCW turned to us for acquisition and predevelopment financing. We participated 50% with The Life Initiative on a $3.9 million acquisition loan to LCW for Marriner, with a term of seven years. We also provided a $1.38 million, seven-year subordinate secured predevelopment loan to LCW, more than double the term of standard NeighborWorks Capital three-year acquisition and predevelopment loans. The longer loan term will allow LCW to redevelop the historic mill in several phases and funding rounds.

When the development is complete, it will include approximately 200 affordable homes at 30-80% of AMI ($26,300 – $68,000 for a family of four.) Rents have increased nearly 50% in the past few years in the largely immigrant, Latino community.

“We were very interested in this building because large mill projects have an immense revitalization effect on the community,” said Jessica Andors, LCW’s Executive Director. “It’s a huge impact for the city symbolically, psychologically, and practically when these neglected and blighted buildings get revitalized and put to use, especially when it’s homes for current residents and local businesses.“

While it has not seen traditional gentrification, Lawrence is a magnet and home base for many new immigrants.

“Marriner’s size will make it a significant contribution to local permanently affordable housing, which is a deep need in a city like Lawrence. We are trying to get ahead of rising rents and potential gentrification by developing solid permanent affordable housing options now.”

Andors met our Chief Lending Officer Steve Peelor at a NeighborWorks symposium a few years ago. She said Steve’s follow-up and engagement with LCW made it so that when the Marriner opportunity came up, he was one of the first people she called.

“Working with NeighborWorks Capital on a predevelopment loan was fantastically helpful. As soon as you buy a building, it starts costing you more money. And because of the size and scale of this project, we knew we’d need a holding strategy that included basic improvements for interim commercial leasing. The NeighborWorks Capital staff were thorough in understanding our needs, and the resulting flexibility of NeighborWorks Capital funds is allowing us to help the building pay for itself, and also contributing to the holding, carrying, and other predevelopment costs while we figure out the development plans,” Andors said.

Originally, we worked on a plan for a five-year loan. After some underwriting, we decided to extend it to a seven-year loan, more than double our average loan length of three years. This is our fourth loan with LCW.

“We worked with LCW and The Life Initiative to structure these loans based on the development timeline of the Marriner, taking into account a realistic timeframe for LCW to develop the site in phases utilizing multiple rounds of LIHTC as well as NMTC and HTC financing,” said our Senior Loan Officer Emily Dorfman.

This is an ambitious project for LCW, whose previous adaptive reuse projects were smaller and included only one phase of development. LCW envisions this project at the nexus of health, housing, and community development. Plans for the Marriner building include incorporating health care components and working with developers of a nearby greenway and rail trail. They have used NeighborWorks America’s resources to inform the planning for these components.

“LCW reinvests our earnings into programs for our residents, including youth development, education and health support, workforce training, financial coaching, and more. Marriner’s size means an even greater impact to reinvest in programs for residents, which is vital to our larger mission, as well as our sustainability,” Andors said.

LCW is a community development corporation that weaves together community planning, organizing, and asset-building efforts with high-quality affordable housing and commercial development to create vibrant neighborhoods and empowered residents. By facilitating conversations and action on community priorities, LCW engages partners and a network of youth and adult residents in opportunities to move themselves and the city of Lawrence forward. LCW has built or renovated over 400 units of affordable housing in Lawrence, MA. It has completed the adaptive reuse of two former mill buildings. The first was also funded with a loan from us. Union Crossing I which included 60 affordable apartments and 95,000 square feet of commercial space. Union Crossing II (Duck Mill project) created 73 affordable apartment homes and 10,000 square feet of commercial space.