Through a nimble and responsive credit solution, we helped customer East Bay Asian Local Development Corporation (EBALDC) expand the flexible capital they need to continue providing affordable homes for families in Oakland, CA.

A Skyrocketing Market Demands Quick Action

Oakland’s real estate market is the 4th most expensive in the nation, and prices are growing faster than in any other market. The tech boom has forced sky high rents in San Francisco, Silicon Valley, and the West Bay, and the inability to build new homes in these areas have forced people out. Many land in Oakland, lowering vacancies and raising rents. This has increased its median income to $93,600,and an affordable 2-bedroom at 100% AMI is $2,340/month!

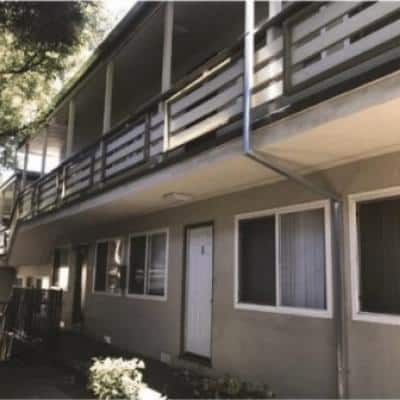

As one of the oldest and most active affordable housing and community development organizations in the area, EBALDC found itself competing with developers wanting to flip and gentrify naturally occurring affordable housing (NOAH), typically smaller, older apartment buildings, displacing low-income families that have lived there for generations.

EBALDC needed more flexible capital than ever to be able to acquire properties, especially as it has increased its focus on the health of neighborhoods in Oakland, rather than moving into nearby cities.

In May 2018, EBALDC asked us to increase the line of credit and revise the terms to fund a $1.5 million draw at 105% LTV for an 86-apartment acquisition, exceeding the 95%/$1 million cap—because $1 million no longer covers it in Oakland.

While EBALDC has long-term financing tools available, we are providing a bridge for the timing gap that those can’t cover. Through three changes to the line of credit—overall increase, more funds for acquisitions, and higher LTV—EBALDC can compete on level terms in a hot market.

“This solution is tailored and structured toward EBALDC’s needs, outside the box, instead of trying to fit them into any predetermined solutions. We are uniquely positioned to help organizations that need this kind of flexibility and turnaround,” said Tamar Sarkisian, our Senior Loan Officer.

Flexible Credit

Recent development opportunities led EBALDC to ask for a new acquisition and predevelopment line of credit for $6.2 million, an increase of $1.6 million. It will be secured against other operating commercial properties—using alternative collateral allows us to reduce the time for analyzing and approving each draw, because we know how intensely EBALDC evaluates each prospective purchase.

“We were able to implement a unique structure in this mezzanine-like product. Our process and procedure allowed for a very quick turnaround, getting them the financing quickly and easily. Separate collateral allowed for flexibility,” Sarkisian said.

Acquisition and Predevelopment Funding

The line of credit includes draws for NOAH properties which EBALDC will acquire and convert into long-term affordable homes. As existing tenants choose to leave, EBALDC will fill vacancies with households at or below 60% AMI ($56,200 for a family of four), to achieve an average of no more than 80% AMI ($74,900 for a family of four) per building. After two early draws for smaller buildings, EBALDC can now close on an 86-apartment property, a better path to scalable economics.

With rapid price increases in the market, acquisitions require a lot more capital. NC’s loan provides $1.5 million in “mezzanine” debt for this new acquisition, and up to $4.2 million in total acquisition fundings, while maintaining up to $3.6 million available for LIHTC predevelopment costs. EBALDC has used NeighborWorks Capital predevelopment funding on 10 properties over the last year-and-a-half.

“They have great, experienced staff handling the volume and turnaround required in the market, so they really mitigate our risk,” Sarkisan said.

About EBALDC

EBALDC has more than 40 years of experience and success operating affordable housing and community-supportive commercial properties in the Oakland area. EBALDC has developed more than 2,600 affordable apartments and more than 230,000 square feet of commercial space in the East San Francisco Bay region. Their strategic plan includes creating healthier neighborhoods in economically distressed and gentrifying areas of Oakland, rather than growth through geographic expansion. They focus on providing vitality, employment, and economic opportunity for the communities they serve. EBALDC’s operating properties are generally at 80% AMI ($74,900 in Oakland.) Their LIHTC projects in predevelopment generally will have incomes from 30 to 80% AMI ($28,100-$74,900 in Oakland.)