NeighborWorks Capital has achieved a milestone of $500 million in loan capital deployed to support the affordable housing development, economic development, neighborhood revitalization, and resident and community services work of NeighborWorks network organizations across the United States.

This investment has supported $6 billion in total development costs and provided over 28,000 affordable homes for families and individuals with household incomes below 80% of the area median and 1.2 million square feet of commercial space for community facilities. This funding reached communities that have been traditionally underserved. 73% of loan capital was deployed in communities of low income, 52% of the funds supported communities with minority-majority populations, and 20% of capital was expended in rural communities.

“We are proud to partner with NeighborWorks network organizations to help them move their real estate developments forward,” said Stephen Peelor, Chief Lending Officer for NeighborWorks Capital. “This milestone achievement was possible because of the strength of the organizations we serve and the variety of high-impact real estate development projects they undertake. Our trusted partnership has resulted in long-term relationships with many Network members returning for multiple loans over the years.”

NeighborWorks Capital’s Board of Directors and Leadership Team are highly focused on growing lending activity with a balanced approach toward mission, impact, risk, and fiscal responsibility. They support network organizations by providing flexible, affordable, and responsive loan products for rental, for sale, and commercial real estate projects, as well as organizational-level loans for capacity building and growth. Their long-term partnership and credibility as a lending partner has allowed NeighborWorks Capital to expand their capacity to bring financial, human, and intellectual capital at scale to under-resourced and marginalized communities and support network organizations to grow their work and impact.

Lisa Getter, Vice President Real Estate at NeighborWorks America, states that, “No matter the challenge, network borrowers have experienced NeighborWorks Capital’s commitment to being true partners beyond the traditional lender definition. Expanding access to flexible capital like this is critical to community resilience and to positioning the network to create and preserve more affordable homes across their communities. NeighborWorks America congratulates the staff of NeighborWorks Capital on reaching this milestone of $500 million in loans deployed across the critically important and impactful NeighborWorks network.”

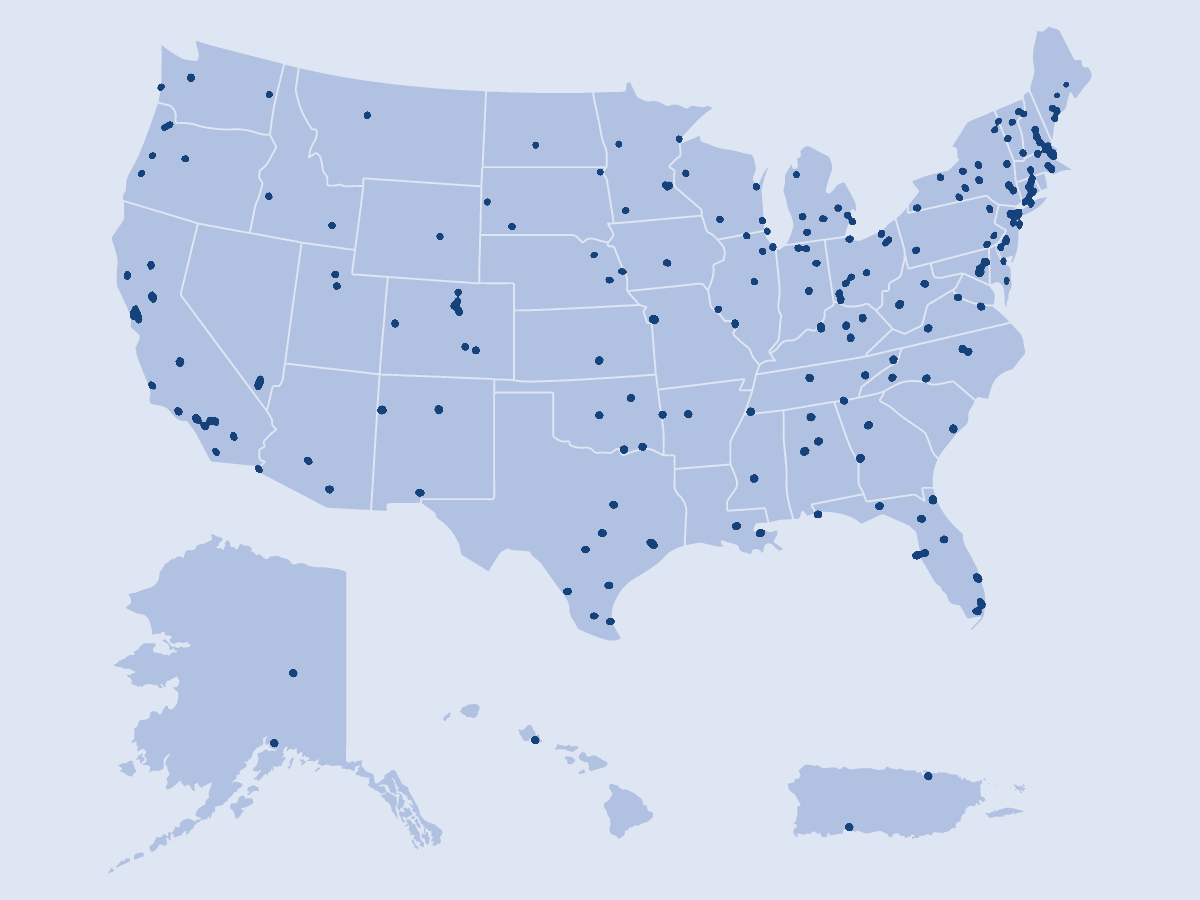

NeighborWorks network organizations work in all 50 states, DC, and Puerto Rico to stabilize neighborhoods and improve the lives of low-income residents. They provide communities with affordable housing construction, repair and financing, financial capability counseling, resident engagement, and equitable community development initiatives. They are resident-led, centered around equity, and truly representative of their community’s goals and priorities. While NeighborWorks America and NeighborWorks Capital operate independently, they have strategic alignment and work in partnership to advance their shared objectives.

About NeighborWorks Capital

NeighborWorks Capital is a national non-profit, certified Community Development Financial Institution (CDFI) serving NeighborWorks America network organizations, nearly 250 strong, capable nonprofit housing and community development organizations in every state, District of Columbia, and Puerto Rico. These organizations provide communities with affordable housing, financial counseling, training, and resident engagement in the areas of housing, health, employment, and education. Since its inception, NeighborWorks Capital has deployed over $500 million in loan capital to support the NeighborWorks network. In 2023, NeighborWorks Capital received its first-ever S&P Global issuer credit rating of A+/Stable, sighting key strengths in capital adequacy, profitability, liquidity, and financial management. The organization has been Aeris-rated since 2011 and has an AA- financial strength and performance rating, indicating strong financial capability, performance, and risk management practices. For more information, visit: https://neighborworkscapital.org/

About NeighborWorks America

For 45 years, Neighborhood Reinvestment Corp., a national, nonpartisan nonprofit known as NeighborWorks America, has strived to make every community a place of opportunity. Our network of excellence includes nearly 250 nonprofits in every state, the District of Columbia, and Puerto Rico. NeighborWorks offers grant funding, peer exchange, technical assistance, evaluation tools, and access to training as the nation’s leading trainer of housing and community development professionals. NeighborWorks network organizations provide residents in their communities with affordable homes, owned and rented; financial counseling and coaching; community building through resident engagement; and collaboration in the areas of health, employment, and education. For more information, visit: https://www.neighborworks.org/