This article was originally published by Shelterforce.

Nonprofit developers produce a significant share of affordable housing development in the U.S., but they don’t have the negotiating power that big, for-profit developers do. As a result, they often end up with worse terms in Low-Income Housing Tax Credit (LIHTC) deals. NeighborWorks Capital and National Equity Fund (NEF) recently set out to change that with the announcement of our NeighborWorks Capital Equity Fund, scheduled to start committing to deals in July. The fund is designed to provide members of the NeighborWorks America network with terms that equal or surpass those offered to the largest national developers—an original avenue to level the playing field in the LIHTC market. Since the announcement, our team at NeighborWorks Capital has often been asked, “This is a great idea; why hasn’t this been done before?”

I believe this positive response stems from two realities of the LIHTC marketplace. First, although the LIHTC market is an efficient system for connecting capital with developments fortunate enough to win a LIHTC allocation, nonprofit developers are at a disadvantage compared to their large, for-profit competitors. Anyone who has negotiated LIHTC terms with sponsors knows this is true. Large developers are able to negotiate not only price per credit, but also various fee levels, timing of equity payments, timing of developer fee payments, and other terms such as reserves and guarantees. Second, although nonprofits have engaged in community organizing for decades, they have not prioritized organizing with one another for their own interests. When industry participants consider the opportunity for organizing, they fundamentally understand the potential benefit for smaller developers. The concept resonates because they know that small developers are at a disadvantage when they negotiate independently.

INEQUITIES IN THE LIHTC MARKETPLACE

During my time in the LIHTC industry, both as a syndicator and with an allocating agency, I saw firsthand that the capital marketplace is not always equitable. Because syndicators and investors need to secure large numbers of transactions in a competitive environment, they often prioritize large developers. Large developers with a significant pipeline have more leverage with investors, and as a result, they often demand and receive better terms. But who’s really developing the most housing? The answer may surprise you.

Each year, Affordable Housing Finance publishes a list of the largest affordable housing developers. The top organizations on that list are consistently for-profit developers. But if it were counted as one entity, the combined, nonprofit membership of NeighborWorks America would be the largest producer of affordable rental housing, year after year. It is anticipated that the 2024 production of the NeighborWorks America network will surpass 8000 completed units—far more than any of the developers on the most recent list.

In addition to being the largest developer of affordable rental housing, the network produces highly impactful properties: housing that serves community needs, based on community perspectives. It undertakes challenging developments serving populations not prioritized by the general marketplace. If you visit a development undertaken by a member of the NeighborWorks America network and visit a development built by a large for-profit developer, you will notice the difference. The community-based nonprofit organizations that make up the network were established to address local community challenges and serve their communities holistically with a longstanding commitment to advancing equity. The features of their developments reflect that commitment to meeting the community’s needs. These organizations deserve and need equitable LIHTC terms to maximize their impact.

Yet NeighborWorks member organizations have always negotiated with LIHTC investors independently. Individually, they typically do not have the size or scale needed to negotiate the same favorable LIHTC terms as large developers. The largest nonprofit developers have some leverage, but not as much as the collective could achieve. NeighborWorks Capital and NEF recently completed an internal analysis of the LIHTC terms that members of NeighborWorks America accepted over the past three years. This analysis confirmed that there was a wide variance in terms, and they were typically less favorable than those the large developers received.

The NeighborWorks Capital Equity Fund changes that dynamic. Every network member will receive consistent terms for LIHTC developments that are on par with, or better than, those typically received by the largest developers. These include favorable exit terms that preserve affordability and protect against potential challenges in retaining ownership of their development at the end of the compliance period. In addition to equitable terms, the fund will allow network organizations to save on legal fees and time spent on negotiating investment agreements.

The fund builds on recommendations made by the Affordable Housing Investors Council (AHIC) in its analysis of its own underwriting guidelines, which advised more flexible terms from investors.

THE POWER OF ORGANIZING

For decades, nonprofit organizations have effectively helped the communities they serve to organize to confront and address inequities. This effective strategy has improved the lives of countless individuals and families and achieved great things for their communities. Community organizing is intended to build power for the people. Nonprofits can claim power for themselves by organizing, too.

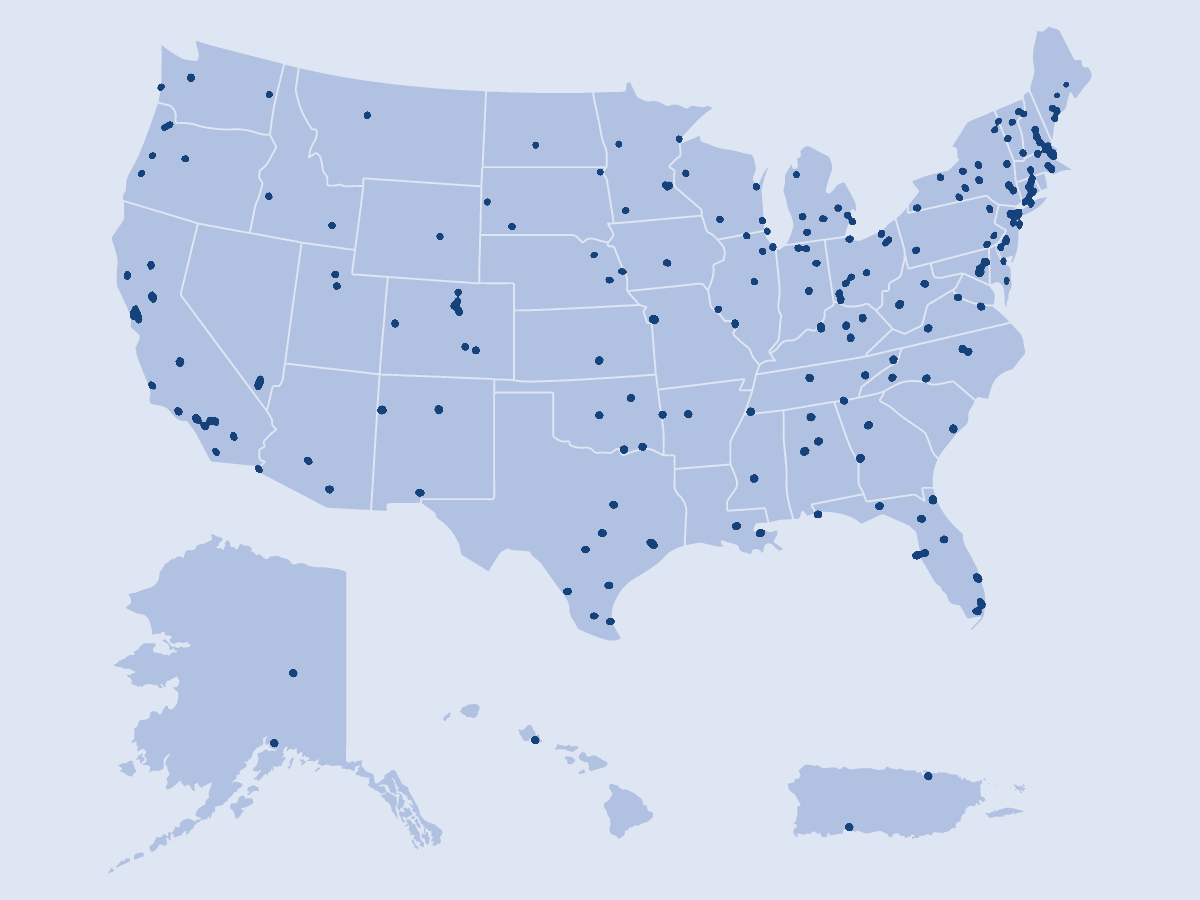

The NeighborWorks America network consists of nearly 250 nonprofit organizations operating in every state plus the District of Columbia and Puerto Rico. The standards for becoming a member of the network are high, and once a nonprofit becomes a member, it becomes part of what I call a “community of accountability.” Network members must demonstrate financial and operational strength. They are assessed every three years for impact, effectiveness, capacity, and plans for growth, and receive a rating and feedback. They receive support as they grow stronger. These organizations share knowledge and help one another grow their impact. In many respects, this network is highly organized, but when it comes to interacting with capital markets, there is tremendous opportunity for improvement.

It is not entirely surprising that nonprofits are not collectively organized in their interaction with national investors. A gap exists between individual affordable housing developers and the large national entities that provide capital. For example, large banks provide a tremendous amount of capital for affordable housing, but they move this capital through relatively small internal teams. These teams lack the capacity to engage with large numbers of nonprofits in various communities nationwide. They often move their funds through large intermediaries, who also operate at scale and cannot touch all communities. The result is that many nonprofits do not have access to national capital with preferred terms, even though their work could be appealing to those investors.

The beauty of the NeighborWorks Capital Equity Fund is that it connects this national network of leading nonprofit developers with those national investors in a way that will address LIHTC market inequities. We view this fund as the first of many future LIHTC funds, and we intend to grow the benefits over time by effectively organizing this network of nonprofits to bring new financial and philanthropic partners into the partnership. In the end, this effort at “nonprofit organizing” will not just benefit this group of leading nonprofits; it will bring more and better resources to communities in need nationwide.

At NeighborWorks Capital, we plan to continue pursuing ways to connect our network of nonprofits with new funding sources. We hope the industry follows suit, and challenges itself to search for fixes for capital market inequities.