NeighborWorks Capital provided People’s Self-Help Housing (PSHH) a $1,275,000 secured and an additional $500,000 unsecured predevelopment loan to develop much-needed affordable multifamily homes in rural Santa Barbara County, California.

PSHH originally came to NeighborWorks Capital for the $1.275M acquisition loan.

“We wanted to support PSHH and this great project by showing our commitment to a customer with a great track-record, so we offered additional support of a $500,000 unsecured predevelopment loan,” said Tamar Sarkisian, Senior Loan Officer at NeighborWorks Capital.

The additional loan will help PSHH cover legal, architect, engineering, third-party reporting, and application costs, without having to tap into their own capital.

“Housing prices are very high in this region, so a project like this is much needed. Many local jobs are tourism- or agriculture-related which do not pay enough to keep up with housing prices,” said Morgen Benevedo, Director of Multi-Family Housing Development for PSHH. “We have multiple properties 30 miles north and 30 miles south of Buellton and have always wanted to serve this region of the central coast. Multifamily sites are hard to come by in Buellton and this is a site we have been following for several years.”

The vacant, unimproved land fell out of escrow multiple times, but they were in the right place at the right time, Benevedo explained. Their relationship with NeighborWorks Capital helped them move quickly to secure it.

“Knowing we have the backing of NeighborWorks Capital gives us the ability to act on opportunities when they present themselves, and this site is a great example of that. There are few affordable home sites in this region so NeighborWorks Capital will help us make it possible to bring much-needed affordable apartments to Buellton. NeighborWorks Capital has assisted us with acquisition financing on two other properties (and one more in process), and in each case it was a positive experience,” Benevedo said.

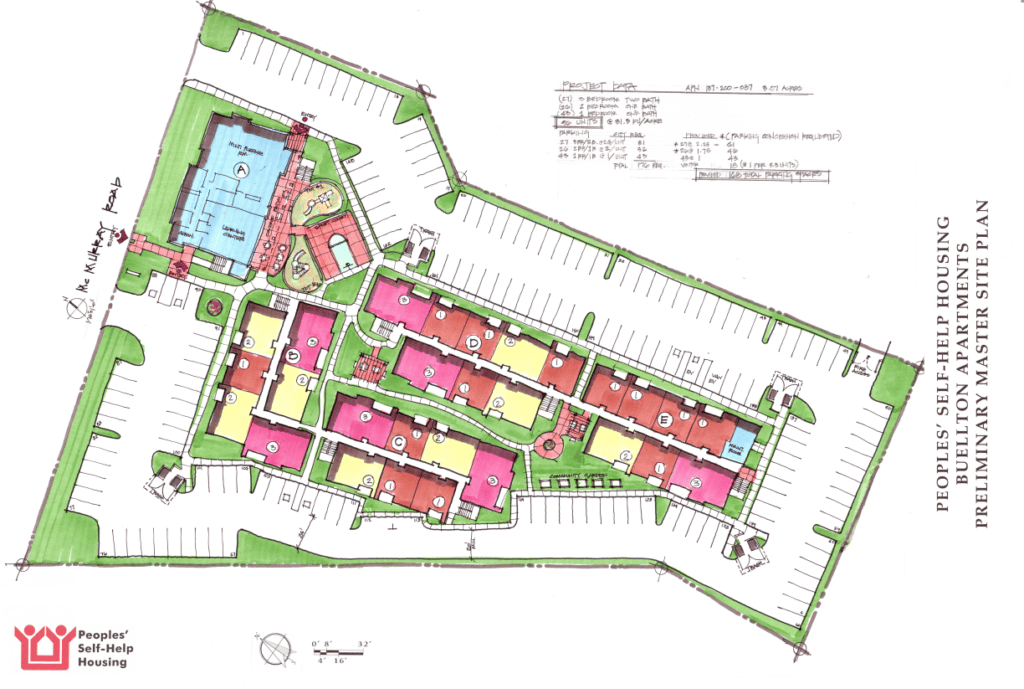

The proposed McMurray Road project is a new construction affordable multifamily development of 75 low-income apartments, a mix of one-, two-, and three-bedrooms with affordability from $26,000 to $53,000 (30% to 60% AMI). Forty percent of Buellton households are classified as very low or low income, and 35% of all households pay more than 30% of their income toward housing. Buellton has a high proportion of owner-occupied homes and a dearth of available rental homes.

PSHH’s new development will be financed using 9% low-income housing tax credits (“LIHTC”), as it is in a rural area; and other development subsidy sources. When there is an LIHTC take out, NeighborWorks Capital will offer recurring customers predevelopment to support the project as well.

There is a need for quality homes for the regional workers and their families.The McMurray Road development will be designed with families in mind and also will have some apartments set aside for veterans. The development will feature building clusters on a campus that includes a community center building, two playgrounds, a barbeque area with covered seating, a common use turf area, a community garden, and a half basketball court. PSSH also offers resident services at its properties to assist with health screenings, counseling, case management, food distribution, nutrition workshops, and senior wellness seminars, among others.

The Supportive Housing Program provides services to PSHH residents to keep them housed, with access to community resources. Social workers meet with residents on-site and provide counseling support and linkage to services such as health care, food, financial resources, transportation, and other basic needs.

“The biggest benefit the resident receive from this program is stability in their housing. The onsite social workers work hard to prevent any of our residents from losing their homes and possibly becoming homeless,” said Rick Gulino, PSHH Director of Resident Services and Neighborhood Development.

The home affordability crisis has only deepened in California in recent years. Santa Barbara County, where Buellton is located, is a very high-cost area. The waitlist for Section 8 vouchers is over 600 long – and has been closed since 2009. One-fifth of renters live in overcrowded conditions. Its housing stock consists primarily of single-family homes, which typically rent for more than apartments in multifamily properties. The affordable home rental vacancy rate is around 1.4%. The area struggles to meet demand and targets for new permits for affordable home construction.

Though a small city, Buellton is one of the fastest growing in the county. The development is in a commercial zoning area in an Affordable Housing Overlay Zone, established to accommodate Buellton’s regional share of affordable housing as required by the state. It is located near Highway 101 and a shopping center that includes restaurants, a pharmacy, a full-service grocery store, and other retail uses. Major industries in Santa Barbara County include government, leisure and hospitality, education, and farming. Regional employers include Vandenberg Air Force Base, the University of California Santa Barbara and several resorts and wineries.

Addressing the Challenges of COVID

PSHH shifted to mainly remote work when California’s shelter-in-place orders came in March due to the COVID pandemic.

“We have adapted well. Whether entitlements or funding applications, our projects continue to move forward. The sudden shift to remote work has caused some agencies to slow but everybody seems to be making a good effort to keep things moving forward. Our property management has fared well with a higher than expected rental collection rate, and the numbers seem to be improving over time,” Benevedo said.

The loan process with NeighborWorks Capital began prior to shelter in place orders, and loan approval and closing began after.

“PSHH was great about understanding any obstacles that would pose a challenge to closing, particularly in a small, rural municipality where hours and staff can be limited. Our positive closing experience with PSHH’s development staff is a testament to their top-notch experience and proactiveness. They are really great at working with these local jurisdictions in the central cost to get the necessary approvals and support for their projects, which helps us all move toward a smooth closing. Having a great relationship with PSHH and the familiarity of our closing process helped us ensure that there were no disruptions or delays in providing them with the financing they needed by the negotiated purchase date,” Sarkisian said.

ABOUT PEOPLE’S SELF-HELP HOUSING

PSHH was founded in 1970 to create affordable housing and self-sufficiency programs on the California Central Coast. Its housing and services support low income families, farmworkers, seniors,

veterans, the formerly homeless, and people with disabilities. PSHH has three primary lines of business: Housing, Property Management, and Community Programs. They have seen significant growth over the last several years.

PSHH’s housing portfolio includes multifamily development/asset management, self-help single-family building and homebuyer assistance program, and construction departments. PSHH operates 48 affordable housing complexes and has developed or renovated 1,952 apartments in 52 properties with over 5,000 tenants. PSHH’s self-help ownership program has helped over 1,200 first time home buyers build and purchase their first home. PSHH has completed seven LIHTC projects in the past five years, four new construction and three rehab projects. PSHH’s Community Programs consists of the Supportive Housing Program (“SHP”), Youth Education and Enhancement Program (“YEEP”), Community Building and Engagement Department (“CB&E”), and Homeownership Counseling Department.