NeighborWorks organizations produce more affordable multifamily units than the top five for-profit developers combined. Yet individually, NeighborWorks organizations typically do not have the size or scale needed to negotiate the same Low Income Housing Tax Credit (LIHTC) terms as the largest multifamily developers. NeighborWorks Capital has partnered with National Equity Fund (NEF), a leading non-profit multifamily, affordable, real estate investment manager, to launch the NeighborWorks Capital Equity Fund, a first-of-its-kind equity fund to exclusively provide NeighborWorks organizations with a set of standardized, equitable LIHTC terms that are consistent with those received by large developers.

Since 1987, National Equity Fund (NEF) has invested over $24.5 billion in 242,500 new or preserved affordable homes for individuals, families, and communities in need across the country. As a leading nonprofit LIHTC syndicator/investor, NEF is focused on generating opportunities rooted in its vision that all individuals and families across the country have access to stable, safe, and affordable homes. While a for-profit syndicator is typically focused on achieving the greatest profit for themselves, NEF balances profit with mission and impact. This results in an aligned partnership with a shared view of success and equitable terms for NeighborWorks organizations.

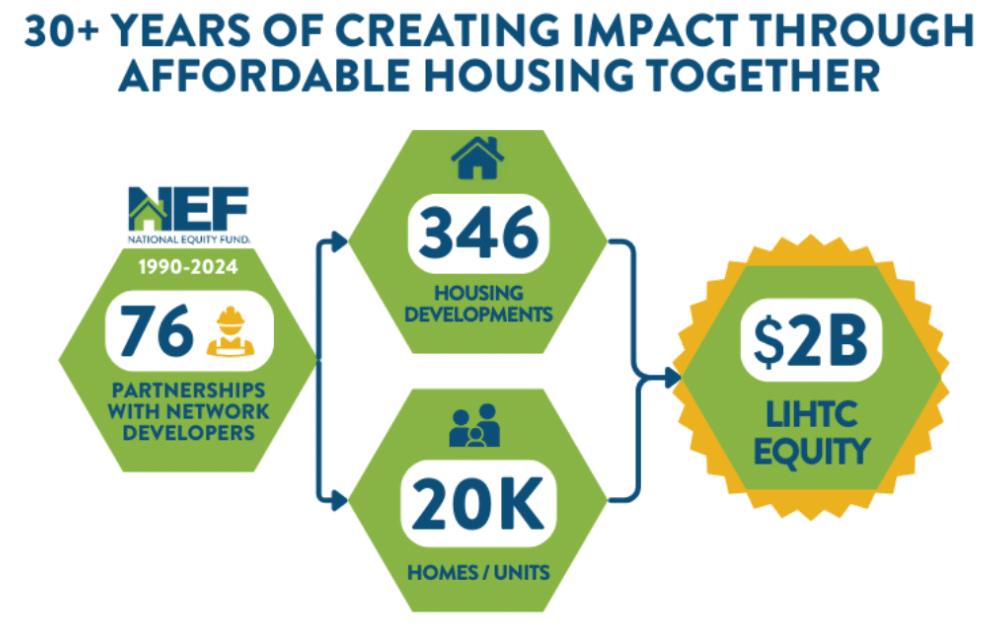

While the fund is a new option for NeighborWorks organizations, NEF is not a new partner to NeighborWorks America. NEF has worked with 76 NeighborWorks organizations to deploy more than $2 billion in equity for the creation of nearly 350 developments across the country, which resulted in approximately 20,000 units of affordable housing. Now, organizations within the NeighborWorks network will receive consistent terms for LIHTC developments, including NEF’s favorable exit terms that preserve affordability and protect against potential challenges in retaining their development at the end of the compliance period. NEF is committed to working with each NeighborWorks organization to structure the deal in the most beneficial way possible and will provide full deal-term transparency to NeighborWorks Capital to ensure equity. Learn more about NEF >

NeighborWorks Capital and National Equity Fund Announce LIHTC Equity Fund read the announcement >

Affordable Housing Finance: NeighborWorks Capital and NEF Partner on Equity Fund read the story >

National Association of Affordable Housing Lenders: NeighborWorks Capital and National Equity Fund Announce LIHTC

Equity Fund to Empower Partner Organizations read the story >

Affordable Housing Finance: Leveling the Playing Field for Mission-Driven Nonprofit Developers read the story >

Shelterforce: Nonprofit Housing Developers Deserve Better LIHTC Terms read the story >

The NeighborWorks Capital Equity Fund is an effort to provide NeighborWorks organizations with access to equitable, consistent LIHTC terms. LIHTC is one of the most used funding sources to create or preserve affordable multifamily housing. Every NeighborWorks organization involved in multifamily development needs to secure these resources, and this market is not a level playing field. NeighborWorks organizations produce more affordable multifamily units than the top five for-profit developers combined. Yet individually, they typically do not have the size or scale needed to negotiate the same LIHTC terms as the largest multifamily developers.

All NeighborWorks organizations of any size and location, with deals of any size and location, will be invited to participate in this opportunity. Deals will then be further evaluated for suitability, but we want to know about all potential deals for consideration.

Projects of all sizes and developers with all volume levels from NeighborWorks organizations will be considered.

Projects in all geographies will be considered. To the extent there is a particular geographic request by a Fund investor, we will reach out to the NeighborWorks organization covering the market.

We are looking to fill the pipeline for this Fund and future funds and want to know about all upcoming projects in your queue.

We expect this Fund to support projects that begin within the next 12 – 18 months.

Yes, as long as the NeighborWorks organization is materially involved and receives at least 51% of deal economics. NEF and NeighborWorks Capital want to see capacity building for the network.

All property types will be eligible as long as the development team has demonstrable experience with the proposed project type. NEF has diverse experience with all property types, including permanent housing, health + housing, veterans, multi-generational, etc.

Your existing NEF contact would be happy to hear from you. Please also let NeighborWorks Capital know about the potential opportunity. For NeighborWorks organizations without a pre-existing relationship with NEF, working with NeighborWorks Capital is the best place to start.

For more information, call our Chief Lending Officer, Steve Peelor, at 240-595-1561 or complete the form below, and we will contact you soon.

Loans@neighborworkscapital.org

Tel: (240) 821-1651

8484 Georgia Ave. Ste 330

Silver Spring, MD 20910

Hours: Mon-Fri 8am-6pm

Get updates on new Financing Solutions and hear about the work our partners are doing to strengthen communities.