WELCOME TO OUR

Blog

Stay informed with the latest news, success stories, and industry insights from NeighborWorks Capital. Discover real-life examples, policy updates, expert opinions, and other information.

NeighborWorks Capital and Federal Home Loan Bank of Atlanta (FHLBank...

NeighborWorks Capital has received a $1 million grant from JPMorganChase...

NeighborWorks Capital is pleased to extend a $2 million line...

NeighborWorks Capital is pleased to provide a $2,000,000 predevelopment line...

We are excited to share with you the next installment...

NeighborWorks Capital is pleased to announce that our annual rating...

NeighborWorks Capital is pleased to provide a $2 million predevelopment...

We are pleased to announce that Jarrod Brennet has joined...

In 2024, NeighborWorks Capital launched a new lending program to...

NeighborWorks Capital is pleased to extend a $400,000 predevelopment loan...

Neighborhood Housing Services of Baltimore (NHS of Baltimore) will use...

We are pleased to announce the addition of Audra Hamernik...

NeighborWorks Capital is thrilled to announce that Ebony Perkins has...

We recently posed an important question to NeighborWorks organizations (NWOs):...

NeighborWorks Capital is pleased to renew a $10,000,000 acquisition/predevelopment line...

We are pleased to announce that NeighborWorks Capital has been...

Our team recently came together for a much-anticipated staff gathering...

NeighborWorks Capital, a national nonprofit and a certified Community Development...

NeighborWorks Capital is pleased to extend a $500,000 predevelopment line...

NeighborWorks Capital is pleased to extend a $500,000 increase to...

We are pleased to announce the addition of two affordable...

NeighborWorks Capital is pleased to extend an $882,400 predevelopment loan...

NeighborWorks Capital is pleased to extend a $900,000 acquisition loan...

NeighborWorks Capital is pleased to extend a $1,000,000 permanent loan...

This year was impactful for our organization, marked by significant...

NeighborWorks Capital is pleased to extend a $673,000 construction-to-permanent loan...

We are pleased to announce that Laura Altomare has joined...

New Kensington Community Development Corporation (NKCDC) is a community-driven, trauma-informed,...

New Kensington Community Development Corporation (NKCDC) is a community-driven, trauma-informed,...

Nonprofit developers produce a significant share of affordable housing development...

NeighborWorks Capital is pleased to extend a $6,000,000 acquisition loan...

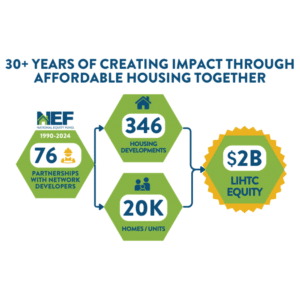

NeighborWorks Capital and National Equity Fund, Inc. are pleased to...

NeighborWorks Capital is pleased to extend a $1,000,000 pre-development line...

NeighborWorks Capital is pleased to extend a $19,000,000 construction loan,...

The innovative fund, exclusive to members of the NeighborWorks America...

NeighborWorks Capital has achieved a milestone of $500 million in...

NeighborWorks Capital is pleased to extend a $6.2 million refinance...

NeighborWorks Capital is pleased to extend a $6.2 million refinance...

The Strategic Growth Fund was established in 2015 by NeighborWorks...

NeighborWorks capital is pleased to participate with the Federation of...

NeighborWorks Capital and Federal Home Loan Bank of Atlanta (FHLBank...

NeighborWorks Capital has received a $1 million grant from JPMorganChase...

NeighborWorks Capital is pleased to extend a $2 million line...

NeighborWorks Capital is pleased to provide a $2,000,000 predevelopment line...

We are excited to share with you the next installment...

NeighborWorks Capital is pleased to announce that our annual rating...

NeighborWorks Capital is pleased to provide a $2 million predevelopment...

We are pleased to announce that Jarrod Brennet has joined...

In 2024, NeighborWorks Capital launched a new lending program to...

NeighborWorks Capital is pleased to extend a $400,000 predevelopment loan...

Neighborhood Housing Services of Baltimore (NHS of Baltimore) will use...

We are pleased to announce the addition of Audra Hamernik...

NeighborWorks Capital is thrilled to announce that Ebony Perkins has...

We recently posed an important question to NeighborWorks organizations (NWOs):...

NeighborWorks Capital is pleased to renew a $10,000,000 acquisition/predevelopment line...

We are pleased to announce that NeighborWorks Capital has been...

Our team recently came together for a much-anticipated staff gathering...

NeighborWorks Capital, a national nonprofit and a certified Community Development...

NeighborWorks Capital is pleased to extend a $500,000 predevelopment line...

NeighborWorks Capital is pleased to extend a $500,000 increase to...

We are pleased to announce the addition of two affordable...

NeighborWorks Capital is pleased to extend an $882,400 predevelopment loan...

NeighborWorks Capital is pleased to extend a $900,000 acquisition loan...

NeighborWorks Capital is pleased to extend a $1,000,000 permanent loan...

This year was impactful for our organization, marked by significant...

NeighborWorks Capital is pleased to extend a $673,000 construction-to-permanent loan...

We are pleased to announce that Laura Altomare has joined...

New Kensington Community Development Corporation (NKCDC) is a community-driven, trauma-informed,...

New Kensington Community Development Corporation (NKCDC) is a community-driven, trauma-informed,...

Nonprofit developers produce a significant share of affordable housing development...